In the Philippines, managing debt recovery is a sophisticated process that demands an understanding of legal frameworks and strategic collection practices.

This guide is meticulously designed to navigate the complexities of debt recovery, ensuring creditors can assert their rights while maintaining fairness towards debtors. Focusing on “debt recovery guidelines,” this article aims to be an invaluable resource for creditors seeking to navigate the challenges of debt collection efficiently.

Legal Framework Protecting Creditors and Debtors

Navigating debt recovery in the Philippines requires a deep understanding of the laws that balance the interests of creditors and debtors. These laws ensure that debt recovery practices are conducted ethically and within the bounds of fairness.

The Financing Company Act of 1998 (Republic Act No. 8556)

This act creates a regulatory environment for financing companies, emphasizing fair debt collection practices. It aims to prevent predatory lending and ensure that collection practices are conducted with integrity and respect for the debtor’s rights.

The Lending Company Regulation Act of 2007 (Republic Act No. 9474)

Regulating lending companies, this law protects borrowers by setting standards for fair debt recovery. It addresses the need for transparency and fairness in lending, offering borrowers protection against exploitative recovery tactics.

The Data Privacy Act of 2012 (Republic Act No. 10173)

In today’s digital age, protecting personal data is crucial, especially in financial transactions. This act impacts how creditors manage debtor information, underscoring the importance of privacy in debt recovery efforts.

Understanding these laws provides a foundation for ethical and legal debt recovery practices, ensuring that both creditors and debtors are treated fairly throughout the process.

Initiating Debt Recovery Guidelines

Effective debt recovery begins with clear communication between creditors and debtors. This phase is critical in setting the legal and ethical groundwork for resolving debt issues.

Demand to Pay: Formal and Informal Demands

A demand for payment, whether formal or informal, kick-starts the debt recovery process. This initial step is vital for establishing the seriousness of the creditor’s intent and sets the tone for future interactions.

Significance of Prior Demand

The requirement of a prior demand highlights the importance of formal communication in establishing a debtor’s default status. This procedural step is crucial for legal clarity and sets the stage for any necessary legal actions.

The act of making a demand emphasizes the creditor’s right to repayment and marks the beginning of formal recovery efforts. It serves as a necessary precursor to more assertive legal actions, ensuring that the debtor is fully aware of their obligations.

Legal Proceedings for Debt Recovery Guidelines

When informal recovery efforts fail, legal proceedings may become necessary. Understanding the appropriate legal avenues is crucial for effective debt recovery.

Barangay Dispute Resolution

Resolving disputes at the Barangay level offers a community-based approach to debt recovery, promoting resolutions that are amicable and less adversarial. This step is essential for fostering goodwill and potentially avoiding more contentious legal battles.

Small Claims Procedure for Debt Recovery Guidelines

The Small Claims Court offers a streamlined and accessible venue for resolving smaller disputes. This process simplifies legal proceedings, making it easier for creditors to recover debts without the need for extensive legal representation.

First Level Courts and Regional Trial Courts

For larger claims, navigating the complexities of the First Level Courts and Regional Trial Courts requires a more sophisticated understanding of legal procedures. These courts handle a broader spectrum of civil cases, offering a formal avenue for debt recovery.

Alternative Dispute Resolution (ADR)

ADR represents a flexible and often less confrontational approach to resolving disputes. Opting for mediation, arbitration, or negotiation can save time and resources, highlighting the importance of finding mutually acceptable solutions.

Navigating judicial processes with diligence and respect for legal protocols underscores the necessity of legal proceedings in debt recovery. They provide structured pathways for recovering debts while ensuring that the rights of all parties are protected.

Addressing Debtor’s Financial Difficulties

Understanding and addressing a debtor’s financial difficulties can lead to more sustainable solutions. Compassionate and practical approaches can facilitate recovery while maintaining the debtor’s dignity.

Financial Rehabilitation and Insolvency Act of 2010 (FRIA)

FRIA offers a legal framework for addressing severe financial distress, providing a path towards rehabilitation or liquidation. This law balances the need to recover debts with the realities of the debtor’s financial situation, promoting resolutions that are fair and achievable.

Foreclosure and Criminal Actions

Foreclosure and criminal actions represent more severe steps in debt recovery. These measures are typically pursued when other avenues have failed, highlighting the seriousness of the situation and the creditor’s determination to recover owed amounts.

Addressing financial difficulties and pursuing legal actions when necessary are critical components of effective debt recovery. These strategies emphasize the importance of tailored approaches.

Conclusion for Debt Recovery Guidelines

Navigating the complexities of debt recovery in the Philippines requires a deep understanding of legal requirements, procedural norms, and strategic considerations. By adhering to the outlined debt recovery guidelines, creditors can assert their claims effectively while respecting debtor rights, aiming for a fair and efficient resolution to debt disputes. This guide not only serves as a valuable resource for creditors but also enhances the visibility and accessibility of crucial information on debt recovery practices in the Philippines.

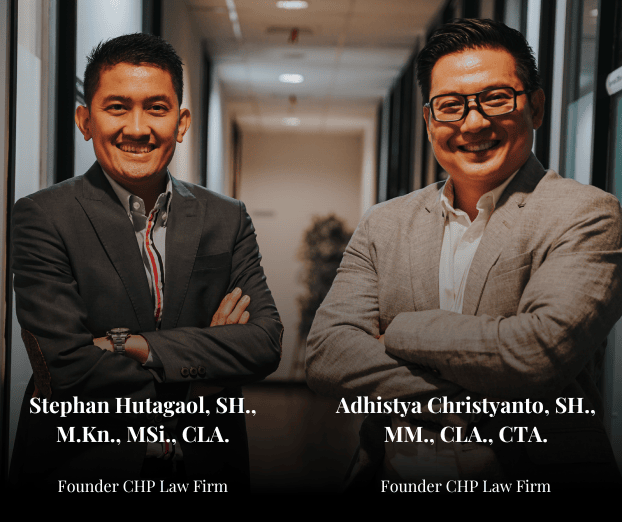

To effectively navigate the complexities of debt recovery guidelines in the Philippines, CHP can serve as the ideal legal advisor, leveraging its expertise to manage cases with precision and care.